uno | dos | tres | cuatro

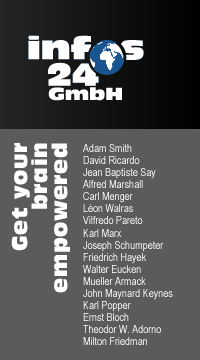

1. classical economy

3. Karl Marx

4. Joseph Schumpeter

5. ordoliberalismo

6. keynesianismo

7. racionalismo crítico

8. crítica filosófica

9. monetarismo

If someone is interested in the biographie of Léon Walras, something completely irrelevant, he found one in Wikipedia. There is no reason to repeat here what have already been said thousand of times.

We are talking know about the three authors, Léon Walras, Vilfredo Pareto and Carl Menger who are the beginning of the tragedy in economic thinking. It would be a great advance if this error would be corrected and if all three were completely eliminated from all textbooks and wouldn't be mentioned any more in the study of economics.

It is very important to see that Alfred Marshall has nothing to do with those three idiots and that it doesn't make any sense to assign him to "neoclassical theory". Neoclassical theory doesn't exist, see neoclassical theory.

Inside the neoclassical theory we can distinguish three schools, the school Lausann (Léon Walras, Vilfredo Pareto), the school of Vienna (Carl Menger, Eugen Böhm Bawerk) and the Cambrigdge School (Alfred Marshall, Francis Ysidro Edgeworth). It is doubtful that summarising these schools or authors under the same term is usefull.

This summarising

is based on three assumptions, all of them incorrect. The first assumptions is that the neoclassics invented the concept of marginality, some people speak in this context of marginal revolution. This is wrong for a lot of reasons. The concept of marginality is so trivial, that everybody understands it and therefore it has been discovered before by millions and millions of people. Everybody understands that the utility of choclate decreases with the consumption of choclate and everybody understand that resources will be reallocated if the last unit of a resource yield a greater benefit used elsewhere. Adam Smith knew that already, see natural price / market price.

It is quite obvious that such a trivial "law" hab been "discovered" already by millions and millions of people and the question whether it was Menger, Gossen, Walras or Jevons who "discovered this "law" is therefore meaningless. It was just common sense. The rent of David Ricardo is a marginal consideration as well. It is the less efficient producer of corn who determines, given a certain demand, the market price.

The second error is that the fact that some individuals have some characteristics in common doesn't mean that the form a group. Dogs and elephants walks on four legs, but they don't belong to the same group. Sharks and dolphins have a lot of things in common, but sharks are fishes and dolphins are mammalians.

Very often we can read that Keynes didn't distinguish between classical and neoclassical theory and that he didn't understood the differences, the "marginal revolution". It is indeed true that Keynes didn't distinguish between classical theory and neoclassical theory. The first reason is, that the marginal revolution never happened. The concept of the natural price / market price is already a marginal consideration. The second reason is, that concerning the basic errors in economic thinking, their concepts of capital, money, savings and interest rates there is no difference.

Furthermore it is said the introduction of the ceteris paribus clause is due to the genius of neoclassical thinking.

This is a problematic statement as well. If we only analysis markets where products are only exchanged but not produced or if analysis what is going to happen in the short run, as it is the case of Leóne Walras, Vilfredo Pareto and Carl Menger the ceteris paribus clause, the assumption that all the other potentially influencing variables remains the same, is not needed, because in the short run nothing, absolutely nothing changes. If we want to put it more philosophically. A moment is not defined by the amount of time that passes, but by the fact that nothing changes. In a second can happen a lot of things and on the moon nothing happens in ten thousand years. Ten thousand years is a moment there. To introduce the ceteris paribus clause in this kind of analysis is completly superfluous, because nothing is going to change anyway.

In the long run, if EVERYTHING changes, the ceteris paribus clause there is a theory neede before we can exclude the assumed irrelevant variables from the modell.

One of the most basic functions of economic is for example the supply curve, actually the marginal cost curve. It is assumed that the costs increases if the production increases. But in order to say that, we do not only need to assume that all other things remain equal, we need to make very special assumptions concerning this cost curve. Even the variable costs can decrease if the amount produced increases. Raw materials can be produced more efficiently if produced in large amounts, the transport of these raw materials became cheaper, per unit, if largs amounts were transported, labour becomes more and more better trained if large amounts are produced, distribution will get better organised etc. etc...

And beside that, in the short run we can abstract from the fix costs, that's what the models do we find in textbook about microeconomics, but not in the long run. If the production potential is only in part fully employed the fix costs per unit will DECREASE if the amount of production increases. The ceteris paribus clause therefore does not only assume that every variables not taken into account doesn't change, it assumes a very specifique situation. It is not very astonishing that therefore that the conclusions draw from models based on the ceteris paribus clause are wrong. Prices, in relationship to the income, DECREASE, always, with the amount in the long run. Almost everything what is nowadays a simple consumer good, refrigerators, televisions, computers, cars etc. were luxury goods fourty years ago, affordable for very few people. Concerning clothes it is not even useful to repair them. They are so cheap, that people just throw them away if repairing them is needed.

The conscious setting of a ceteris paribus clause requires a theory. Before we can assume something as irrelevant for our object of study, we must know WHAT is irrelevant.

In other branches of science, for instance medecine or molecular biology, the procedure is different. Normally the studies are done at the cell level, an enviornment that can be controlled. The results obtained are then tested in more complex organisms, normally mice. Testing a theory against reality is more complicated. If there is a theory about a causal chaine, knock out mice can be produced, in other words mice that are genetically changed so that the assumed causal chaine is not possible any more. If the wild type mice and the knock out mice undergo the same treatment and only the wild type mice show the expected results and the knock out mice not, there is certain evidence that the theory is true.

The ceteris paribus clause is meaningless. If we don't know the causal chaines, there is no guarantee that the relevant variables are assumed not changing. If the problem is so trivial that we know from the very beginning which variables are relevant and which are irrelevant, than we don't need the ceteris paribus clause either.

In every science we have some strategy to overcome the problem that we can't reduce the complexity, but only in economics this is a big issue and one can ask oneself why this is the case. One possible reason is that in economics the desire to immunise the theory against realit is greater than in other science. Every time someone argues that the theory doesn't comply with reality it can be argued that some conditions assumed to be not changing has actually changed, but the theory is right. That way there is no way to test a theory against reality.

The second possibly reason is the importance given to mathematical modelling. If we want to calculate the equilibrium price, in a ficticious example, a reduction of complexity is needed. Actually it would be enough to say that market economies have a tendency to an equilibrium, although they never reach it, because on the way to equilibrium something changes, but that would be to easy to understand and woudn't look very "scientific". It is crystal clear that resources will be reallocated if they can earn more money elsewhere. If the prices of an item increases, it becomes interesting to produce it and resources will be reallocated. If a print worker earns more money as webdesigner because more and more texts are read online, he will undergo the training needed and work as a webdesigner. That's very simple to understand and not complicated at all. In order to make some mathematical exercises we need a clearly defined supply curve, are clearly defined demand curve and then we can calculate the equilibrium price, the price that optimises the profit, the monopol price etc. etc.. The logic behind can be explained in plain words in 15 minutes, but that doesn't look very scientific. Therefore we have to simplify a bit reality in order to complicate it afterwards a bit with some mathematical equations and in order to simplify reality we need the ceteribus paribus clause.

By definition the ceteris paribus clause leads to a static economy. If nothing changes, we have a static economy. If there is something on earth we really don't care, something completely irrelevant, this is a static economy. We are never interested in equilibriums of any kind, although "neoclassic" theory is all about equilibriums. What we really want to know is how productivity can be increased in order to get an equilibrium at a higher level.

From a pure didactical point of view mathematical modeling has an desastrous effect, because it suggests that the amount reacts on a mechanical way to a change of prices and the prices in a mechanical way to a change of the amount. The two fundamental functions of prices in a market economy, the pillar of a market economy, are not explained. Prices contain informations, are signals and the basis of human decisions. That the first poiint. The second point is that prices present an incentive. People who doesn't react on a change of prices will get into trouble and persons who react on a change of prices benefit. Market economies are nothing that happens without human decisions as it is suggested by the mathematical or graphical model, see allocation of resources.

The paragraph below shows that Léon Walras didn't understand at all the fundamental pillars of market economy. He compares the "the law of demand and supply" with the astronomic laws that steers the mouvements of the planets. If we abstract from all the dynamic parts of the economy, most at all from the demand side and if we assume that nothing changes, we have a relationship between price and amount, but that is only a tautology and not a naturale force like gravity or the centrifugal force in astronomics.

If someone want to sell 10 apples, the means of payment are pearls, Léon Walras assumes that just anything can be a means of payment, and the buyers in total have 5 pearls, than we get 2 apples for one pearl if the seller wants to sell all his apples. This is tautological and has nothing to do with a "law".

[To be precise: The seller has to adapt his price until the buyer get more utilitiy buying apples with his pearls than buying peaches. If he wants to sell his apples for one pearl, the buyers would buy for instance peaches.]

With these tautologies we explain nothing and most of all we can't explain the different levels of the equilibrium prices in space and time. Pure tautolgies are ALWAYS true, that's their problem. Anybody with a little bit of common sense get in five minutes to deeper insights on economics than Léon Walras with 300 pages. Léon Walras is a poor idiot, what is actually not the problem. The problem is, that academic teachers continue quoting him is the inventor of the general equilibrium. In other words, they are as idiot as Léon Walras himself.

| C'est la loi de l'offre et de la demande qui ordonne tous ces échanges de marchandises, comme c'est la loi de la gravitation universelle qui régit tous les mouvevements des corps célestes. Ici le système du monde économique apparaît déjà dans son étendue et sa complexité, et peut sembler aussi beau, c'est-à-dire aussi vaste et aussi simple à la fois, que le système du monde astronomique. | The law of supply and demand steers the change of merchandises the way the universel law of gravity steers all the mouvements of the planet. Here already the economic law appears in its universal validity and its complexity and nothing can appear so beautiful, in other words great and at the same time so simple as the systeme of the astronomic world. Léon Walras, Element d' economie politique pur, ou theorie de la richesse sociale, 34 Leçon |

All the tragedy of economic thinking is illustrated in this small paragraph. This kind of thinking leads to socialism, to the idea that the economy is steered by some simple laws and no coordination through the market is needed. If the economy would work like universe, steered by stable laws, it would be possible to determine the optimal allocation of resources with some equations and these simple equations can be better resolved by a central planning commission than by the market.

It is not really astonishing that nobody really cares about the opinion of economists, see prelimaries. If they try to forecast economic development with the same methods as astronomers forecast the next solar eclipse they will always fail and at the end nobody will take them seriously. They will become kind of clowns.

Market economies doesn't guarantee any precise result, but there is some evidence that it is a system that leads to the best use of scarce resources. There is no "law" that leads automatically to general equilibrium, but there is a tendency towards an equilibrium. although this equilibrium is never reached, because the underlying producticon structure, preferences, organisation, size of the market, intensity of competition, technological advance, know how, education system change always.

Any of this changes can have a large impact on the economy. In order to determine this change we not only need to know the effect of the changes, but we need to know which changes will happen, especially, being know how the most important producticon factor, see education, we must know what we will know tomorrow. If that were possible, the scientific advance of the last 2000 years could have done as well in 5 minutes and the advance of the next 100 years in other five minutes. Common sense understands, that this is an idiot assumption. The problem is, that economists don't understand that.

Those who argue that economics as a science is impossible if we refute the existence of economic laws, didn't understand the joke. It is possible to put forward arguments in favour of a certain economic order, but we can't forecast the concrete economic results and if it is possible to forecast the economic results, we don't need a market economy. In other words: There is no need to seek something, if we already know where it is.

If economists do the same research than entrepreneurs, they can be useful. Entrepreneurs has to evaluate a situation, getting as much information as possible and they have to try to forecast the future. Some will do that better than others in other words it is a logical consequence of market economies that some will fail. However very often the situation is so complicated, that it is beyond the capacities of an entrepreneur. This happens for instance very often in the case of investments in foreign countries. But in order to do something useful, the economist needs special skills, for instance languages. With a knowledge about the astronomic laws of economics he will not reach very far.

Economists can play an important role in political opinion forming. Few people has the time to gather all the information about the public health system, the pension system, the education system etc.. to form himself an opinion based on facts, especially if some people have no interest to deliver theses facts. See preliminaries.

If we want we can regard the poblem as well from a more philosophical point of view. Following Karl Popper it is impossible to forecast the social development and attempting to approach social development to an imagined ideal is ideological. This is a similar problem. If someone is convinced that he knows what best fits all, he doesn't feel a great need to ask people what they want. If someone believes that economic laws steers the economy, he feels as less the need to ask people about their opinion as the astronomer find it useful to ask people when the next sun eclipse is going to happen. The fact that politics plays no role in economic thinking is not accidental, it is a logical consequence, although only Milton Friedman will say it clearly.

[And socialist countries actually don't feel any need to ask people for their opinion. Sometimes they have elections, but only parties that agree with the socialist ideology are allowed to stand for election, because only these parties accept the universal economic laws of socialism. In the now deceased East-Germany these universal laws where part of the constitution.]

The approach of Karl Popper is different and the underlying philosophy in democracies is the same as in a market economy. The truth is to be find out by trial and error.

There is little difference between the assumption that something like universal economic laws exists and to describe an ideal state or order and in general the ideal economic order is justified by the validity of eternally valid economic laws, that "prove" that there is no alternative.

Eternally valid economic laws proves that the free market economy is the best order and eternally valid economic laws prove the exact opposite, central planning is the best order. The truth is, that economic laws don't exist and therefore nothing can be proved with economic laws.

And if we want to illustrate the problem with a nice example, we can take David Ricardo. David Ricardo had a lot of eternally valid economic laws, none of them was ever true and especially not enternally. Land yields a rent in Europe, but only if the European Community pays subsidies in order to keep the farmers alive. In industrialised countries the population actually growth, but in individual weight and not in number. The number shrinks. Wages are under subsistence level, if people don't have a car and can't make holidays two times a year.

There is obviously no need to discuss the strange theories of Léon Walras, Vilfredo Pareto and Carl Menger. From a purely practical point of view it is a waste of time. The problem is that modern textbooks about microeconomics all over the world are crammed with this nonsense and students lose a lot of time reproducing that, time that could be spent in something useful.

However the situation is still worth. It is not only a waste of time, but it confuses a lot of people. If students learn that price adapts themselves to the amount or the amount to prices and that there is no human decision making needed, that market economies are steered by economic laws the same way the universe is controlled by the laws of physics, they don't understand the pillars of a market economy and we will get very few entrepreneurs and everybody wants to become a public employee where indeed no much human decision making is needed. But that only works if the underlying economic structure can afford that.

return to the top of the page...

The "marginal revolution" is considered the common characteristic of all "neoclassical" authors. However the marginal revolution never happened. We find this concept already in the work of Adam Smith.

Léon Walras is the most radical representative of a line of thinking that assumes that the methodological approach of physics suits as well for economics.