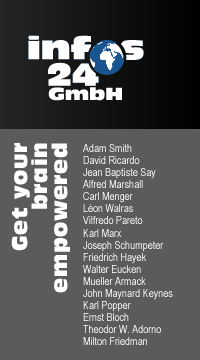

one | two | three |

1. classical economy

2. neoclassical economy

3. Karl Marx

4. Joseph Schumpeter

5. ordoliberalism

6. keynesianism

7. critical rationalism

8. philosophical criticism

9. monetarism

If we put "Why is economy difficult?" in Google, we will retrieve many articles about the topic at a more or less abstract level. A better question would be "What is difficult in economics?".

It is clear that a theory must be based on facts and, thus, it should be possible to test its accordance with facts. Every kind of modeling (in fact, this is the very idea of modeling) includes an abstraction from the facts and only the facts considered as relevant become part of the model. Mathematical modeling is an extreme version of this methodological approach, but there are others as well. The ceteris paribus clause, the assumption that every other parameter remains unchanged, abstracts from the fundamental problem of a market economy. If the fundamental question is how to deal with an ever-changing world, the assumption that nothing changes is not very helpful (see mathematical modeling).

When it becomes apparent that a theory is wrong, there are several ways to deal with the problem. We can construct another theory based on the same facts or take more facts into account.

To illustrate this with an example, it is often said the Keynesian theory turned out to be wrong in the 1970s because deficit spending only led to higher inflation. If we consider the facts in more detail, we will see that the inflation was due to the oil price shock caused by an abrupt rise in the price of oil induced by the oil exporting countries. This phenomenon had nothing to do with Keynesian theory.

The current financial crises (this is written in 2014) is also interpreted by many as a failure of Keynesian theory. It is said that public spending led Greece to bankruptcy. If we consider the facts in greater detail, we see that public spending in Greece was used for consumptive purposes and that the demand induced by public spending was satisfied through imports. Keynes never said that this would work.

The Austrian School takes another approach. Its members do not analyse the facts in greater detail but instead interpret the same fact they identify, namely that an increase in public spending leads to major public debt, using another theory. For them, the core problem is the low-interest rates. They say that with the introduction of the euro in Greece, interest rates decreased. (By the way, this is something necessary to the Keynesian theory and the case of unemployment.) Due to the low-interest rates, the Greek Government created an expansive monetary policy (which the newspapers interpreted as a Keynesian policy).

From that, a lot of newspaper articles deduce that the problem would not have occurred with high-interest rates, something that is clearly true for if interest rates are very high, nobody will borrow money, and if no one borrows money, debt does not increase. However, unemployment remains high. This is equivalent to saying that it is preferable for a patient die than to take a risky medicine.

In most cases, it is not the theory that is difficult to understand, but the facts. In the case of Greece, for instance, an explanation is needed as to why it was so difficult for the Greek Government to identify profitable real investments, in other word, investments that would make it possible to pay back the loan.

It is often said that economics is "difficult". This affirmation doesn't make any sense if it not defined what "complexity" means in this context.